Technology has changed the way, how the world works. It has equally affected the banking system as well. Today, people have round-the-clock access to banks due to online banking. Gone are the days when you had to stand in a queue waiting for your turn to deposit/withdraw money. Getting a bank statement or updating a passbook seemed like a difficult task. Sometimes the work which generally takes minutes took hours. Now, with digital savings account there is no need to worry. A Savings Bank Account, which many of us have, has also become Digital over time. Nowadays, several banks, both public and private are offering Digital Savings Bank Accounts to customers for which they don’t need to opt for the old and traditional method to go to the branch. In the current times, you can open a Digital Savings Bank Account without going anywhere. Besides many banks providing the services of digital accounts, some banks are known for their best digital savings account facilities.

Below mentioned are some of the best online savings account in India.

-

SBI Digital Savings Account

SBI Digital Savings Account is one of the best digital savings accounts. Individuals can open an account by filling up the online account form and visiting the bank branch with KYC documents to activate the account.

Eligibility: To be eligible for an SBI Digital Savings Account, an individual must be over 18 years of age, have an Aadhar number & valid Permanent Account Number (PAN) and have a valid Mobile Number & active email address.

Benefits of SBI Digital Savings Account

- SBI Digital Savings Account is a zero balance account, and it does not have a minimum average balance requirement.

- Customers can personalize their debit card as per their liking.

- Customers can also use other officially valid documents such as Passport, Election Card, and NREGA. to open the account.

- Individuals need to visit the branch once to open the account and use it with no restrictions.

- The account opening is a full-fledged account and customers don’t have to visit the bank branch again to complete any KYC formalities.

- The digital savings account is meant for individual use. Customers are not eligible to open a joint savings account.

- Customers get a classic debit card with no issuance charges. However, the annual maintenance cost of a regular savings account will be applicable.

- The charge of the cheque book will be as per the regular savings account.

- The account statements will be sent through email. Also, you can check your account details through the YONO app.

-

Kotak Mahindra 811 Digital Savings Account

Kotak Mahindra Bank is considered to be one of the pioneers of Digitalization when it comes to the Savings Bank Account. It’s Kotak 811 Digital Bank Account that provides the flexibility to spend and earn up to 4% interest per annum on the savings account balance. The reason behind the name of this Digital Savings Account is that individuals don’t need to go anywhere to open an account. It is often considered among the best online savings account in India.

Eligibility: To be eligible for this account, an individual should be a Resident Indian with the age of 18 years and above.

Benefits of Kotak Mahindra 811 Digital Savings Account

- Interest rate: Earn up to 4%* interest p.a. on your savings account balance

- No Minimum Balance: Enjoy banking with no balance commitment

- Virtual Debit Card: Shop online with ease using your virtual debit card

- Free funds transfer: Transfer funds online for free using NEFT or IMPS or RTGS

- Physical Debit card: Request a physical card through Net-banking or Mobile Banking App and get it for Rs.199+applicable GST per annum

-

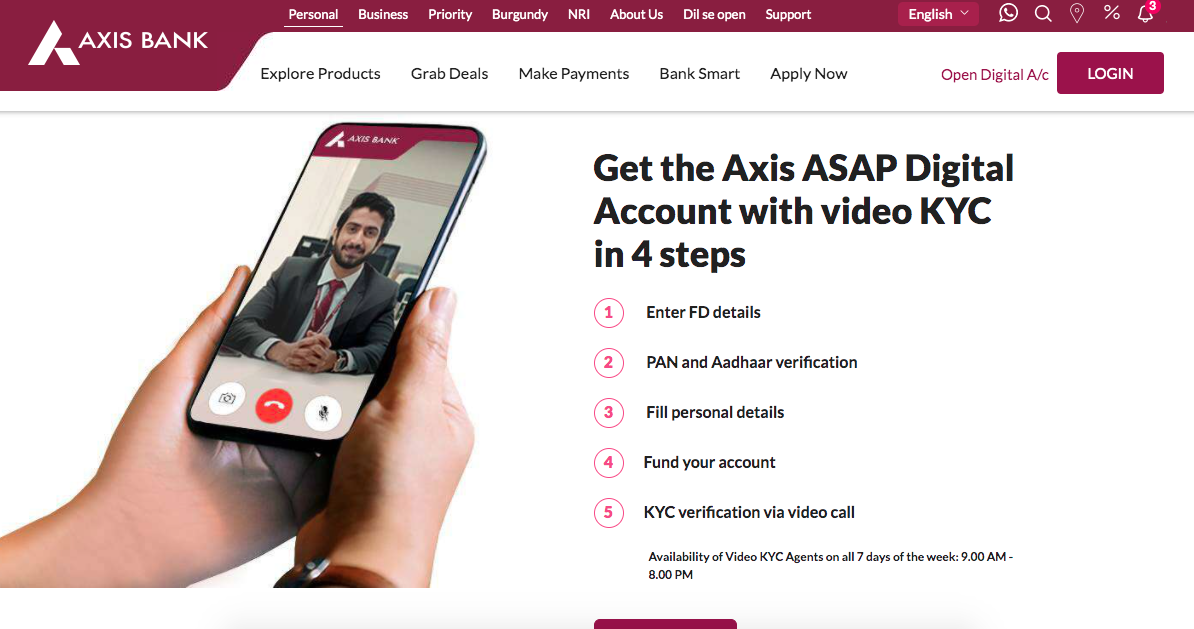

Axis Bank ASAP Digital Savings Account

The Axis ASAP Digital Savings Account is your avenue to open a Savings Account anytime anywhere! Axis Bank offers two types of Digital Bank Account – Easy Access and Prime Savings Account. It provides a Full Power Digital Savings Account with first-of-kind Video KYC. Axis bank provides services of the best online savings accounts in India.

Eligibility: You should be an Indian citizen, must have an original PAN and Aadhaar number, your Aadhaar must be linked to a valid mobile number. You must be at least 18 years of age and you should be applying for an account opening from India. Apart from that, the Desktop/Laptop or Mobile Device with which you are opening an account should be enabled with a camera and microphone facility for the Video KYC process.

Benefits of Axis Bank ASAP Digital Savings Account

- Online access to all of Axis Bank’s 250+ services

- Secure transactions via Debit card, UPI, NEFT, IMPS, and RTGS post account activation.

- An Online Rewards (physical) Debit Card as well as an E- Debit Card (virtual) each with its exclusive offers

- Avenue to securely update your Signature and banking details from anywhere via the Axis Mobile app.

- The initial funding Requirement for both accounts is different. For the Easy Access Account, customers need INR 15,000 while INR 25,000 for Prime Savings Account.

- With both the accounts, customers get a VISA E-Debit card with which they can get up to 1% cashback on all online spending. So, if you are someone who likes to spend online, this could be suitable for you. The minimum transaction to get the cashback should be INR 500 and you can get a maximum cashback of INR 200 in a month.

- The best thing about the Axis Digital Savings Account is customers get Complimentary Times Prime Membership which includes Free subscriptions of Gaana Plus, Zee5, Cure. fit, 15% off on Myntra, and many other exciting things.

- This Complimentary Times Prime Membership can be unlocked by completing 3 transactions within 60 days of opening the account.

-

DBS Digital Savings Bank Account

One of the latest and popular things that DBS Bank has done is customers do no any more need to enter OTPs. Instead of this, DBS bank has in-built soft token security that authenticates all transactions.

Eligibility: You are not an existing account holder of DBS. You are an Indian citizen and an Indian resident. You are over 18 years of age with the capacity to contract under the applicable laws in India. You have a valid and active local mobile number registered in your name, a smartphone, and a valid and active email address of your own. You have downloaded the Digibank app on your Mobile Phone/Device.

Benefits of DBS Digital Savings Bank Account

- With the DBS Bank Digital Savings Bank account, customers get to enjoy Digibank Delights. With this feature, you can get INR 150 cashback as soon as you add INR 10,000 to your account or Fixed Deposit. On spending INR 3,000 with your Digibank Debit Card, customers also get INR 150 as cashback. Both of these offers are valid within 10 days of opening.

- Customers get free-of-cost Debit Cards that come loaded with DigiBank Delights across several categories such as Wellness, Dining, Shopping, Entertainment, Travel, etc.

- With DBS Digital Savings Bank Account, customers also get features like Tap to Pay and Scan to Pay that enable instant payments and transactions any time of the day from anywhere.

- Keep a hawk’s eye on your spending and make smarter decisions effortlessly, with the Spends Optimiser feature.

- No more manual typing or copy-pasting, share your account details with anyone with just a click.

-

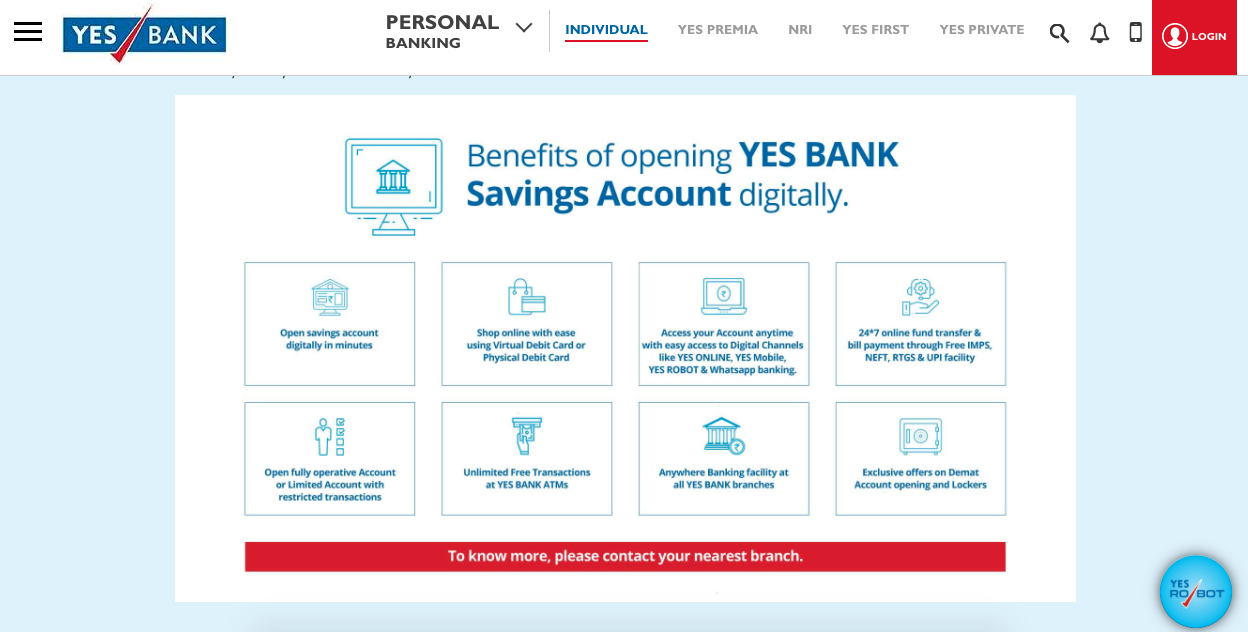

YES BANK Digital Savings Account

YES BANK allows customers to open a Savings Account at their convenience. The overall process to open a Digital Savings Bank account is fast, easy, and most importantly, paperless. YES Bank Savings account can be opened digitally at the comfort of your home.

Eligibility: Resident Individuals. Foreign nationals residing in India. 18 years & Above. YES BANK also offers minor accounts that are self-operated or jointly operated with a parent or guardian.

Benefits of YES BANK Digital Savings Account

- Open Savings Account Online with YES Digital Savings Account as it is easy, fast, secure, and paperless. Fill up the online application form, verify your Aadhar card, PAN card, email ID, and mobile number. Complete the KYC via a video call with a bank official. On successful approval, you can begin using your digital savings account instantly.

- The convenience of online banking at any time and from anywhere is what sets YES Digital Savings Account apart. You can safely access the YES ONLINE and YES MOBILE banking facilities from the comfort of your home or office.

- YES BANK offers free banking across all branches. You can also get free e-statements. To top it all, you have a 24×7 personal banking assistant – YES Robot, to help you pay bills, create fixed deposits, check balances and assist in other banking errands.

- The YES Digital Savings Account offers you attractive interest rates on your account balance, allowing you to grow your wealth steadily. It also provides quarterly interest pay-outs.

- On opening your YES Digital Savings Account, the bank provides you with a lifetime free Visa Platinum virtual debit card. It has a daily transaction limit of ₹50,000 for all your daily online shopping and bill payments.

- Another major benefit of signing up for YES Digital Savings Account is that you can make free of cost NEFT, RTGS, and UPI transfers via net banking and mobile banking.

-

HDFC Bank Digital Savings Account

HDFC Bank, a leading private sector bank of India, allows customers to open a Digital Savings Bank Account instantly via their Smartphones. This type of account is known as HDFC InstaAccount. Several people don’t want to visit the branch to open a savings account. An HDFC Bank Digital Savings Bank account is perfectly fit for such people.

Eligibility: Customers who are 18 years and do not have an existing HDFC Bank Account are eligible for HDFC InstaAccount. Remember, the account cannot be held jointly with any other individual; it can be held by only one individual.

Benefits of HDFC Bank Digital Savings Account:

- Transfer money and/or have your salary credited to this account as soon as you open it.

- Withdrawing money easily from ATMs – Make Cardless Cash withdrawals using your mobile phone:

- Your HDFC Bank InstaAccount lets you withdraw cash from an HDFC Bank ATM without a Debit Card. Simply press the cardless option on the ATM and follow the instructions

- NetBanking and MobileBanking are automatically enabled for your account:

- Your instant online Savings Account or Salary Account is NetBanking and MobileBanking enabled, so it’s easy to check your balances immediately once you have set your password

- For your protection, outgoing payments are only enabled after the first 48 hours of opening your account. After that, you can send money and pay bills easily.

-

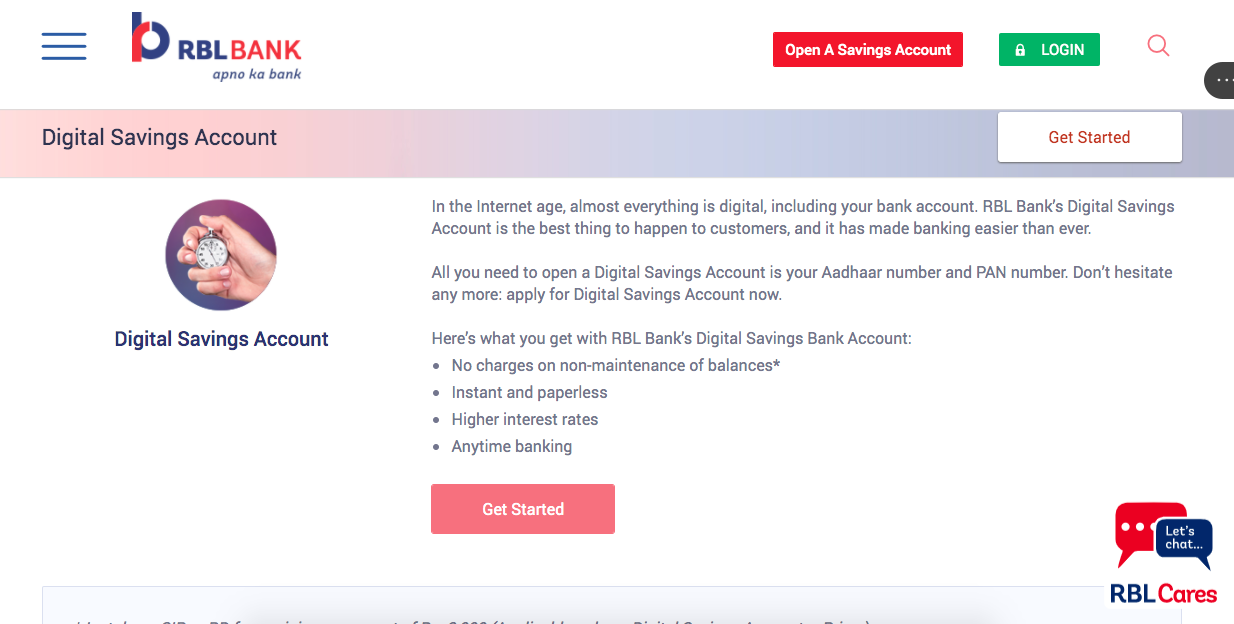

RBL Bank Digital Savings Account

RBL Bank’s Digital Savings Account is the best thing to happen to customers, and it has made banking easier than ever. All you need to open a Digital Savings Account is your Aadhaar number and PAN number. With facilities like Anytime Banking from anywhere, Paperless & instant procedure and higher interest rates are some of the top features of this Digital Savings Bank Account from the RBL Bank.

Eligibility: To be eligible to open an account on RBL Bank one must be 18 years or above, must be a resident individual of India, and should carry an Aadhar and PAN card.

Benefits of RBL Bank Digital Savings Account

- Anytime you want to check on any transactions in your account, just log in to RBL MoBank 2.0, and they will all be there. Find out if payments have been debited, and funds credited to your account instantly.

- You can transfer money instantly to anyone, whether it’s family members, suppliers, or retailers. Plus there are several options like IMPS, NEFT, and RTGS. And most of these fund transfers are free with no additional cost involved.

- Withdraw cash from any of RBL Bank ATMs across the country at no cost, or those of any other bank.

- Take advantage of higher interest rates on your Digital Savings Account.

- The Digital Savings Account has a bill payment facility that enables you to pay all your electricity, landline, mobile, gas, and other bills quickly and easily.

- When you open a Digital Savings Account at RBL Bank, you also get Virtual Debit which can be used for Online Shopping, Recharges, Scan & Pay at merchant outlets, or Paying bills.

- It has robust security systems to ensure that your account is safe. Measures like two-factor authentication ensure that your account is safe and secure, and only you can access it.

- The Digital Savings Account makes investing so easy. You can put your spare cash in a fixed deposit in a matter of seconds and ensure that you maximize your returns. You can also put your money in other avenues like mutual funds through our Digital Savings Account.